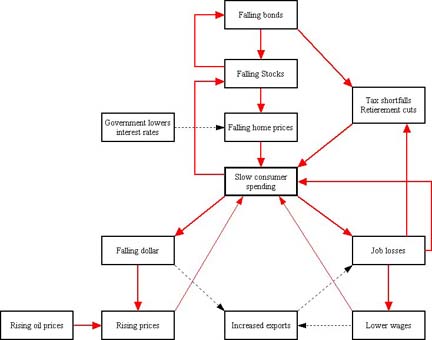

Economies have feedback mechanisms

that stabilize them and govern inflation and recession. This is a

simplified version of the United States' feedback mechanism:

If a recession were to start (diagnosed by slow consumer spending), stocks, bonds, and the dollar would all fall. Jobs would be lost, too. All of this would make the recession worse. However, the trade balance would shift and exports would become more competitive, which would create jobs, pump money into the economy, and eventually correct the recession.

If the economy were to overheat (diagnosed by a rampant stock market), bonds would go up, the dollar would rise, people would be hired with the surplus money, and so forth. All of this would make the situation worse. However the trade imbalance would go negative and exports would become too expensive for our overseas customers, jobs would start to go overseas, and the bubble would eventually deflate.

This model places consumer spending in the path of most of its possible feedback loops. It predicts that consumer spending will be diagnostic of any economic cycle.

In practice, economists watch consumer spending and the consumer price index like hawks because most of their models predict the same thing.

The semiconductor industry is dominated by consumer electronics sales. This is a luxury consumer spending item. As it turns out, a small economic slowdown causes their sales to plummet and they lay off half their laborers. Also, a slightly overheated economy causes their sales to soar and they can't meet demand.

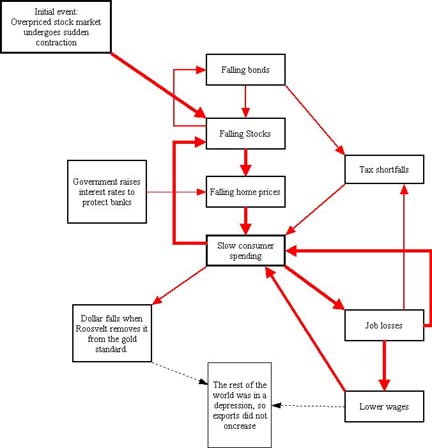

In 1929 we had an overheated economy and a huge stock market bubble. The feedback picture was abnormal as well:

The dollar was backed by gold as the Constitution required, so the dollar didn't fall. This helped things. However, there was a money shortage. So President Roosevelt took the dollar off the gold standard. When he restored the gold standard later the dollar had fallen to nearly half its value.

The rest of the world was already suffering a worldwide depression, so the falling dollar did not help exports much.

Interest rates were raised to protect the banks instead of lowered to protect the economy. Perversely the falling economy damaged the banks even more than lowering the interest rates would have.

In summary, the corrective feedback mechanisms were broken (no dashed black arrows). So when a major stock market correction occurred everything span out of control and just kept getting worse.

This crisis lasted almost 10 years. By 1932 a third of the jobs were gone, and a similar number of farmers lost their land and livelihood. Sixty percent of the men were unemployed or underemployed that year. Foreclosures were everywhere and homes were being auctioned for pennies on the dollar. The stock market was down to 10% of its bubble value. The economy took 6 years to gradually recover.

Both dominant feedback mechanisms overlapped with "slowed consumer spending". This is born out by the fact the consumers had no money during the great depression. If you talk to the ones who are left, you will see how even now they never take out consumer loans, don't spend much money on consumer goods, and never throw anything away.

The winners were the ones who had bonds in 1929, and then sold them to buy real estate.

The 1929 scenario can be described this way: Half the jobs went away.

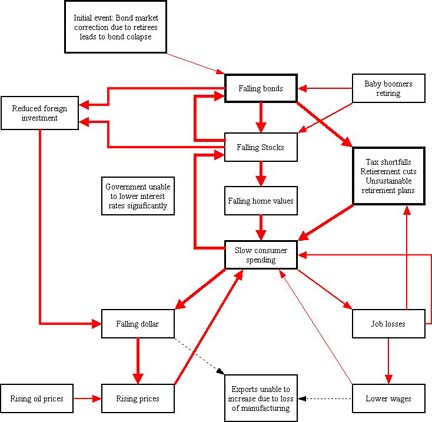

The United States is facing a crisis called the "debt bomb", and the ticking fuse is demographic. The bomb will go off near 2018-2019, plus or minus about 10 years, and the crisis will last about 10 years. This has been common knowledge in financial circles since the 1980's. Followup: The Government Accounting Office sounded the "last chance to do something" alarm in 2007, but didn't get much attention because times were still sort of good.

A large demographic segment called "the baby boomers" has supplied an ever-increasing tax base from the 1960 through 2000. They have bid up the price of homes with their prosperity. They put huge amounts of money in the stock & bond markets for their retirement (raising them to stratospheric levels).

When they start retiring, they

will do it en mass, removing a large tax base. For every 4 boomers that

retire, one man will enter his prime earning years. This will happen

starting in 2008. Half the American workforce will retire close to

2018. By 2028 the boomers will all have retired, their

numbers will start dropping, and their children will enter their prime

earning years. However, by that time there will only be 2 workers per

retiree, and most workers have low-paying jobs.

Home values will fall with less

people trying to buy them and more people trying to sell them, and

retiring boomers will take money out of the stock & bond markets.

Also, there will be a rapidly increasing number of customers for those

retirement and medical benefits. Followup:

The

housing market fell by a factor of two in 2008.

The many existing government

health care guarantees will become unserviceable as large numbers of

boomers retire from prime taxpayers to become health care &

retirement

benefit consumers. With our current tax rate and demographic segments,

health care guarantees alone will gobble up all tax money, leaving

nothing for anything else.

The debt bomb will go off near 2018-2019 (plus or minus 10 years). A financial crisis of one kind or another usually occurs every few years, and that will be the trigger. The bomb may go off all at once with a single crisis, or in stages over years from a series of less dramatic crises. Update: This has been developing as a series of smaller, but serious, crises. There have been short periods of partial recovery between.

The government will not be able to

lower interest rates as much as they would like without fueling

inflation. The dollar will be dropping and prices will be rising, and

lowering interest rates will make this worse. So they will lower

interest rates a little and that will help a little. Update:

Interest rates have already been

taken down to nearly zero.

The United States has lost much of its manufacturing capability, so the falling dollar will not help exports much. It will take at least 10 years to regain the ability to manufacture and export enough to correct this.

The city, county, state, and federal governments will be unable to raise money by selling bonds. This is how we have always bought our way out of trouble before.

Boomers will be steadily selling stocks & bonds for their retirement. This will depress prices in those markets for 20 years.

Governments and large companies

have committed to long term medical and retirement payouts they won't

be able to

afford, so they will have serious budget problems from 2008 through

2040. Update: This has begun.

Oil prices will increase slowly but steadily in inflation adjusted prices, and even faster for the consumer as the dollar falls.

The value of the dollar should be

lower because of the long term trade imbalance. It has been propped up

by foreign investment in American financial markets. When stocks &

bonds drop significantly, foreign investors will start to withdraw and

the dollar will drop much faster.

Update:

The dollar dropped by nearly a factor of 4 from 2000 to 2013. An

interesting aside is that the official inflation rate was low

during that period. A lot of Federal spending is indexed to inflation,

so changing the formula to keep the official rate low saved the Federal

government a lot of money.

It may be difficult to tell when

the debt bomb goes off if things unfold gradually, rather than suddenly

like in 1929. We will be able to say that the debt bomb has already

gone off when California is unable to meet its bond obligations. Update:

This has begun to unfold as a

series of crisises.

All main feedback mechanisms overlap with slowed consumer spending. Consumer spending will drop a lot as financial markets drop and prices increase. Consumer spending is the pillar of today's American economy, and any prolonged decrease means economic recession.

Two main feedback mechanisms overlap with "falling dollar". The dollar will drop a lot when the debt bomb goes off.

Two main feedback mechanisms overlap with "falling bonds", and bonds are part of the trigger. The bond market will collapse when the debt bomb goes off.

Retirees will see fixed incomes lose much of their value. Bond funds will shrink and prices will go up as the dollar falls.

Whether gradually or suddenly, the dollar will drop a lot from 2008 to 2028. It simply must, and this is the time frame.

A falling dollar plus rising

prices spells inflation. There will be significant inflation. Followup:

We have implemented

"quantitative easing" to recover from the 2008 credit crisis,

effectively doubling the money supply and making the coming inflation

worse.

Home values must drop when measured in inflation adjusted dollars. Followup: this has been happening since 2006. Because of inflation, the price tag seen by the American consumer may not change dramatically.

Inflation plus recession is called "stagflation". It is difficult to remedy. No established government action improves both at the same time.

The effect from this will reach around the world, resulting in a global stagflation or depression echoing the American one. Once again, this may unfold suddenly or gradually.

It will be good to hold gold and silver. They are a poor investment during good times, but good to have during bad times.

A mortgage with a fixed interest rate less than the rate of inflation pays you income that you can't see. The amount you owe shrinks in inflation adjusted dollars. Debt that shrinks is invisible income. On the other hand, it won't be any easier to make the payments. And if you are late with a payment the bank can foreclose or "accelerate" your loan to get out of it, meaning you have to refinance at the going rate or lose the house.

It will be good to live on

property that is paid for or financed with a low fixed rate mortgage.

Other wealthy countries have similar

problems, and their problems will manifest at the same time as ours

because things are

interrelated. Some will default on their bonds, and this will have a

domino effect on the others.

The bond markets are basically

collateral for the highly leveraged international financial system. A

multiple default

event this big will disrupt most financial markets, and each disruption

will provide a short-term shock to the world economy.

Credit is the international currency. A

debt bomb will make credit harder to get. This in turn retards

recovery, and makes the problems last longer. Followup:

This has begun to happen with

the 2008 credit crisis.

The American Federal government won't

default on its bonds because our biggest bondholders are the retirement

accounts for

Americans. It will inflate the currency instead when it can't meet its

bond obligations. This means those bonds will be worth less.

The 2018 scenario has been a long time in the making. It started slowly; few people even noticed that the economic foreplay began in 2002. That's when the dot-com bust, 9/11, and the war on terror started the dollar's slow steady slide downward. This will continue until America regains a positive trade balance. The dollar will drop much quicker when the debt bomb goes off.

The consumer can observe inflation and the drop in the dollar with the price of gasoline. Gas goes up as the dollar drops. Although it isn't a precise indicator, the price of gas goes up and down with supply and demand. The price of gold is a good indicator too.

The sector that has grown the most since 2002 is gasoline (because of the rising prices). If we discount this some of this growth as money sucked out of the pocket of the consumer, the consumer spending picture won't look as good.

The slow fall of the dollar has retarded American economic growth by increasing prices (particularly fuel prices) and reducing consumer spending. Any economic disruption will be worse, and risk starting the "falling dollar, rising prices & slowed consumer spending" feedback spiral.

The biggest economic sector is "services", it is 2/3 of the American economy. It is heavily economy sensitive. A large drop in consumer spending may trigger a "slowed consumer spending, job losses, lower wages" feedback spiral.

Sooner or later more and more foreign investors will notice that their American investments have been steadily falling in inflation adjusted dollars since 2002, while appearing profitable on paper. Even the unsophisticated ones will notice that gold investments have been outperforming American ones for a long time. As more and more of them pull out we will see the "falling stocks & bonds, reduced foreign investment, falling dollar & slowed consumer spending" feedback spiral take hold.

The Federal and many state governments pay for budget shortfalls with bonds, and then sell more bonds to pay for the old bonds. When foreign investors buy fewer American bonds, and only ones with much higher interest rates, this will trigger the "falling bonds, tax shortfalls & slowed consumer spending" feedback spiral.

The life span of today's cars is shorter than this crisis. Replacing them during the crisis will be hard. Most Americans cannot work without a car. This will prove to be a problem.

The price of labor will fall in inflation adjusted dollars.

Clothes, shoes, & consumer electronics are imported and will become much more expensive in inflation adjusted dollars. Food is mostly domestic and will go up less.

Right now America has a "throw-away" culture. They buy lots of cheap imported stuff that doesn't last. They won't be replacing many of these things during this crisis. By the time this is over the American will never take out consumer loans, not buy many consumer goods, and their perception of quality will shift from styling & features to reparability & longevity.

America will be exporting a lot more after 2042 than it does today.

The winners will buy gold &

silver while the prices are still low (preferably before 2008). They

will sell it at high prices when everyone flees the financial markets

for gold (driving up gold prices). They will use it to buy real estate

for pennies on the dollar. Real estate markets usually lag the stock

market by about 18 months, so the best buys are between 1 and 2 years

after the stock market bottoms out. Stocks will be a good investment

again once the market bottoms and inflation ends.

Other winners will have business that

buy on

credit, sell in cash, and pay back the credit in depriciated currency.

Paying off real-estate loans in depriciated currency is another winning

move.

Paying a house off only partway may not

be a winning move. All money you paid is lost if you lose the house

anyway.

Historically, there have been times when

countries let inflation get out of hand. Most reined it in within a

year or less, and then introduced a new currency with one or more zeros

lopped off (this makes prices in the new currency similar to

pre-inflation prices and eliminates embarassing currency with lots of

zeros). In half of those cases, the banks prevailed on the government

to modify mortgages to be payable in new currency only. Anyone who paid

off their mortgages before the surprise adjustment won, and everyone

else got stuck holding the bag.

During the great depression the federal government was expected to provide services for huge numbers of the suddenly homeless. It had to do so for about 10 years. These hordes were a threat to local authorities because of the possibility of mass squatting, the fear they might organize and make demands, etc. Their numbers were more than local authorities could manage. So local authorities ran them off whenever and wherever they were found trying to stay the night. The pattern of homeless aid by federal authorities, persecution by local authorities, not being allowed to form groups, and constantly being run off will probably repeat in some form, as it was after hurricane Katrina.

When a country endures bankruptcy, its military suffers along with everything else. The military training and maintenance budgets get gutted. It takes several years for most of the men to serve their terms and the equipment to require overhaul. While on paper the military has only a small reduction in men and equipment, the well trained men are replaced with poorly trained ones, supplies are scarce, and working equipment is hard to come by. This condition lasts until recovery.

Prices will go up and up and up as this crisis unfolds. Low income Americans will find it harder and harder to cope. America will wind up with increasing poverty and homelessness.

Middle income Americans will also

feel the price squeeze as this crisis unfolds, borrowing against their

house to make ends meet. Many will wind up losing their houses. Those

with variable rate mortgages will see their payments become very large.

Transportation is currently most American's second largest expense. It will become a big problem during the debt bomb. The biggest transportation cost is the purchase & repair of the vehicle (it will go up a little slower than inflation), then gas & insurance (it will go up a little faster than inflation). So transportation costs will shoot up as the dollar drops.

As governments get desperate for tax revenue, politically correct gas and energy taxes will look very attractive. These taxes will increase transportation costs and the cost of living, further strangling the economy. Whether these taxes will be enacted is unpredictable.

The Japanese crash of 1990 was

similar to what the American 2018 crash will be. The Japanese had a

prolonged bubble economy. Corporations and individuals had borrowed

heavily to buy stock and land at inflated bubble prices. When the

bubble popped it sucked the money out of their corporations and many

employers went out of business. Consumers saw their investments

evaporate and their debts remain. Consumer spending was reduced by

debts and job losses. Their economy crashed quickly at first, and

shrank gradually for a long time. Causes for the extended downturn

included long term debts from the 1980's, an aging population, and an

ever dwindling workforce. Update:

Their economy stabilized and started

growing again in 2007, but was immediately smacked down by the American

bubble bursting in 2008. The Japanese government tried to

stimulate it's economy by borrowing heavily, so they have a debt bomb

now also.

America's scenario will have some differences from the Japanese one. We won't have an ever shrinking workforce. Our employers won't have their money sucked away all at once. But our economy is much more dependent upon consumer spending, and our consumers will get hit harder. Also, there will be all those bonds that need to be paid and we won't be able to sell many new ones. And there will be all those impossible health care and retirement benefit guarantees.

After the debt bomb explodes, the American economy will be pushed down for the length of the baby boomer's demographic event, from 2008 through 2042 (maximum pressure in 2028). It will also be pushed down over the term of all those bonds, most of which will be paid off within 10 years. Increased exports will be a corrective factor, but it won't be large enough to be significant in less than 10 years. So the crisis will last approximately 10 years.

The people who came through the great depression of the 1930s never took out loans. They did without for as long as it took to save up and buy in cash. They lived this way the rest of their lives because they saw what could happen when you owe money.

Update: It looks

like the

following scenario will play out. Falling confidence in US bonds causes

an increase in interest rates. This increases the country's debt load.

This causes even lower confidence, even higher interest rates, and an

even greater debt load. A positive feedback loop ensues. The Federal

government will try to inflate their way out of the impossible debt

load, but the problem will be too big. This leads to hyperinflation.

Update: Interest

rates started going up in 2013, and it appears irreversible.

Update: Jobs are being added slower than the workforce grows, and this trend shows no signs of changing. Because of the increasing trouble this document describes, it looks like the following scenario will play out. People find it hard to enter the job market or find work after job loss. People with less education and skills will be hit hardest, but everyone will be affected. Wages will not grow, meaning they will fall in inflation adjusted dollars.

The 2018 scenario can be described this way: Prices will go way up and investments will go way down.

Right now, low income Americans' biggest expense is housing, followed by food & transportation (tied for 2nd place). They have to spend their savings or borrow to make ends meet.

Right now, middle income Americans' biggest expense is housing, followed by transportation, then food, then taxes. They save an average of only $2000/year (nearly zero), typically through 401(k) plans and paying down the principal on their mortgage. They have no substantial liquid assets. Their assets have been increasing all of their lives, but these assets are mostly the value of their home plus a little 401(k) money. Their assets have been falling in inflation adjusted dollars since 2006, while appearing to increase. Update: The value of real estate fell substantially in 2009 and is not expected to recover (it was overvalued). Home values will continue to fall in inflation adjusted dollars.

IRA and 401(k) managers have seen something new since 2002: Homeowners have started pulling money out of their retirement just to keep their houses because of rising prices.

"Fannie May" buys mortgages from "good" borrowers. They are starting to default. This trend will continue. Update: The housing bubble burst in 2008 and a foreclosure crisis developed.

Credit card companies have seen

something new: A big increase in people running up credit card bills to

get by. When they have to choose between paying the credit card bill,

mortgage, rent, or car payment, they pay the credit card. They need

their credit card to buy food & gas.

Churches have seen something new: People

and even families have to choose between keeping their car and keeping

their apartment in large numbers. They always choose the car. Sleeping

in the car is no longer considered unusual.

IRAs, 401(k)'s, and other retirement accounts have been steadily dropping in inflation adjusted dollars since 2002. They are mostly stock, bonds, and annuities. Stocks & bonds have been going up from 1932 to 2000.

Home values have been steadily dropping in inflation adjusted dollars since 2006. They steadily increased from 1932 to 2000.

The steady pronounced drop in the dollar is unprecedented for this country. The government has identified it as a threat to the nation, potentially allowing foreign powers leverage to coerce our government. The US dollar was once the international currency, but is being abandoned as it drops.

New warning sign: The 2008 financial crisis led to a series of bailouts and stimulus spending to restart the economy. The currency was inflated by over 100% and an unprecedented number of bonds were floated.

The CIA keeps track of the current account balance of all countries. America brings up the end of the list with federal bond debts much larger than federal assets. Followup: Federal debt exceeded the GDP in late 2011. This is like you owing a years wages (pre-tax) on your biggest credit card.

Americans will buy metal & solid wood furniture that can last a lifetime. Today's particleboard furniture can't stand up to kids or be repaired. The market for this stuff will shrink.

Adults will buy leather shoes and take them to the cobbler when they need resoling or repair. They will have just a few pairs of good shoes instead of a closet full of cheap ones. Leather shoes are more expensive to buy, but look nicer and are cheaper to own because they last longer.

Americans won't buy cheap fashion clothes that don't last.

With the price of labor down and the price of clothes up, it will make sense to pay someone to make a quality custom tailored garment (at least, until recovery is complete and prosperity returns).

Most surviving cars made before the late 1970's were built to last and designed to be repaired. Most cars made after the early 1980's weren't. Trucks have always out-lasted cars (they sell to a more demanding market). Trucks and classics will be in demand and have better value than they do now. Americans will become more sensitive to transportation costs.

Many of today's appliances rely on a small plastic part that breaks after 5-10 years (sooner in the presence of children). Many have expensive feature laden controller boards that are less reliable than simple ones. Americans will become less tolerant of this sort of thing. They will prefer simple, robust appliances with fewer electronics.